housing allowance for pastors worksheet

Taxes with housing allowance Salary of 50000 Housing Allowance of 28000 Reduction of Taxable Income 50000 - 28000 22000 Taxed on 22000 12 2640 Owed income tax of 2640. Resolved that the total compensation paid to Pastor FirstLast Name for calendar year 20__ shall be Pastors Compenstation 00000 of which Amount 00000 is hereby designated as a housing allowance.

Housing Manse Parsonage Designation.

. CLERGY HOUSING ALLOWANCE WORKSHEET METHOD 2. And it is further. This worksheet is designed to help a clergyperson determine the amount that he or she may exclude from gross income.

A housing allowance is also available to a minister living in a parsonage to the extent he uses the allowance for his personally paid out-of-pocket costs not paid by the church. Get the most out of your Ministers Housing Allowance. Section 107 of the Internal Revenue Code IRC states that.

If a minister owns a home the amount excluded from the ministers gross income as a housing allowance is limited to the. Officially designated in advance housing allowance. Ministers Housing Expenses Worksheet.

For this reason RBI has three online housing allowance worksheets available for you. Ive created several tools that will help you as you review your housing allowance. If you receive as part of your salary for services as a minister an amount officially designated in advance of payment as a housing allowance and the amount.

Ad Clergy Housing Allowance Worksheet More Fillable Forms Register and Subscribe Now. Enter fair rental value of. We also have a Housing Allowance Resolution drafted for you on our website.

2 the amount actually expended by the clergyperson for housing. The IRS lists only food and servants as prohibitions to allowance housing expenses. Free Minister Housing Allowance Calculator Worksheets.

2020 Minister Housing Allowance Worksheet Mortgage Payment Real Estate Taxes Homeowners Insurance Mortgage Down Payment Closing Costs Rent Renters Insurance HOA DuesCondo Fees Home Maintenance Repairs Utilities Furniture Appliances Household Items Home Supplies Yard Service Yard Care Tools Supplies Miscellaneous Other. In house payment Umbrella liability insurance Furniture and accessories Appliances Furnishings art and decorative items Decorator services Lawn care maintenance equipment gardening Improvements. Information for Retired Ministers Regarding Housing Allowance 08-19 Page.

Housing Allowance Exclusion Worksheet. Download the free resource now. A pastors housing allowance must be established or designated by the church or.

The housing allowance exclusion only applies for federalincome tax purposes. This worksheet will help you determine your specific housing expenses when filing your annual tax return. One for a pastor who lives in a manse one for a pastor who rents and one for a pastor who owns a house.

A housing allowance may include expenses related to renting purchasing which may consist of down payments or mortgage payments andor maintaining a clergy members current home. Pursuant to the provisions of Section 107 of the Internal Revenue Code Code. Adopt a housing allowance resolution prior to each calendar year or prior to the arrival of a.

It may not encompass expenses incurred as the result of commercial properties or vacation homes Any items for inclusion must be personal in nature for the. Rent if a primary residence was ented for all or part of the year Down payment on a home Remodeling and improvements Installment payments on a mortgage loan to purchase or improve your home. Heres a link to the form weve used for this purpose.

A ministers housing allowance sometimes called a parsonage allowance or a rental allowance is excludable from gross income for income tax purposes but not for self-employment tax purposes. Our Pastors Wallet online calculator can be used to both anticipate expenses for the coming year and review the past years expenses. Those provisions provide that a minister of.

Of his or her expected housing expenses for the year. MINISTERS HOUSING EXPENSES WORKSHEET. Propertyreal estate taxes and homeowners association fees _____ 11.

Is the housing allowance also excluded from earnings subject to self-employment taxes. In that case at most 5000 of the 10000 housing allowance can be excluded from the pastors gross income in that calendar year. Housing Allowance Worksheet for Retired Ministers 081-9 I77663016.

AGFinancial is a DBA of Assemblies of God Ministers Benefit Association. The Regulations require that the housing allowance be designated pursuant to official action taken in advance of such payment by the employing church or other qualified organization. Other allowable expenses eg annual cleaning _____ TOTAL _____ STEP TWO.

Housing Exclusion Worksheet Minister Living in Home Minister Owns or Is Buying Ministers name_____. Use a housing allowance worksheet 2010 template to make your document workflow more streamlined. Clergy Worksheet 2010-2022 Form.

Ministers Housing Allowance Worksheet Approval The housing allowance amount is approved by the executive pastors signature via an annual compensation document. In this illustration there is a 3360 tax savingswith the Housing Allowance. The ministers housing allowance designation is only an.

The amount spent on housing reduces a qualifying ministers federal and state income tax burden. A housing allowance is an annual amount of compensation that is set aside by the church to cover the cost of housing related expenses for its ministers. Online Housing Allowance Calculator.

Housing allowance exclusion This is the amount a retired minister legally canexclude from income taxes and is limited to. It can be downloaded and attached to your Session minutes or simply incorporated into the language of. Resolved that the designation of Amount 00000 as a housing allowance shall apply to calendar year 20__ and all.

The preferred way to do this is for the church councilboard to. Housing allowance for pastors worksheet. Ad Looking for pastoral housing allowance form.

Properly designated housing allowance _____B The amount excludable from income for federal income tax purposes is the lower of. Housing allowance designated by the church or other employer _____ 2a Board of pensions as noted on IRS Form 1099R _____ 2b 2T Total officially designated housing allowance. Content updated daily for pastoral housing allowance form.

New pastor and record the resolution in the minutes of the meeting. A worksheet is provided for the ministers use upon request. In that case at most 5000 of the 10000 housing allowance can be excluded from the pastors gross income in that calendar year.

This document is the ministers.

Pastoral Housing Allowance For 2021 Pca Rbi

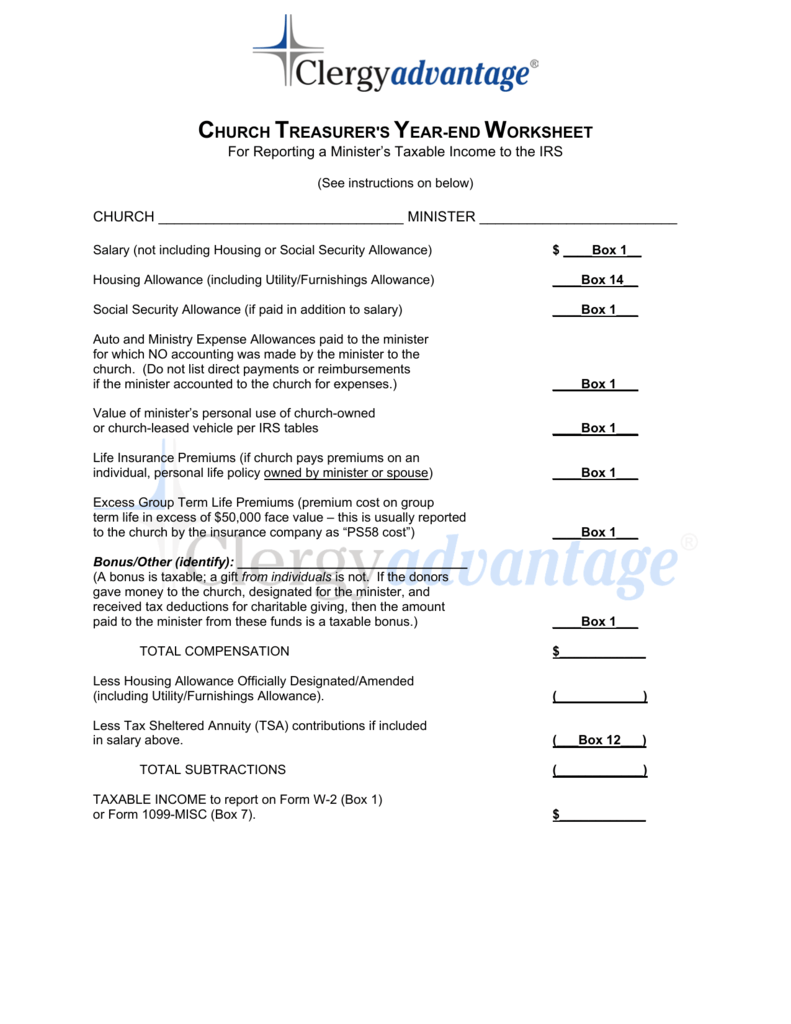

Church Treasurer S Year End Worksheet

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

Housing Allowance Worksheet Clergy Financial Resources Download Fillable Pdf Templateroller

Housing Allowance Request Form Brokepastor

2020 Housing Allowance For Pastors What You Need To Know The Pastor S Wallet

Clergy Housing Allowance Worksheet 2010 2022 Fill And Sign Printable Template Online Us Legal Forms

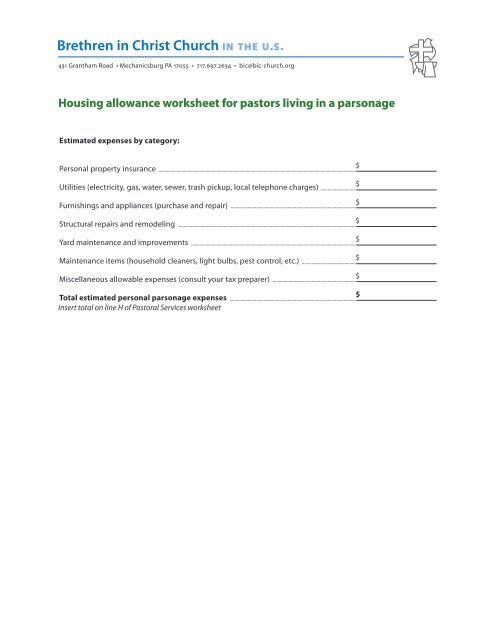

Housing Allowance Worksheet For Pastors Who Live In A Parsonage

Get Your Free Downloadable 2019 Minister Housing Allowance Worksheet The Pastor S Wallet

Fillable Online Agncn Housing Allowance Request Ncn Assemblies Of God Agncn Fax Email Print Pdffiller

Housing Allowance Worksheet Clergy Financial Resources Download Fillable Pdf Templateroller Housing Allowance Clergy Allowance

2022 Housing Guide Pdf Download Clergy Financial Resources

Housing Allowance Worksheet Fill Out And Sign Printable Pdf Template Signnow

Pca Retirement Benefits Inc Housing Allowance Worksheet Fill And Sign Printable Template Online Us Legal Forms